The Definitive Guide for Investment Consultant

Table of ContentsFinancial Advisor Victoria Bc - An OverviewRumored Buzz on Financial Advisor Victoria BcLittle Known Facts About Independent Investment Advisor Canada.Facts About Ia Wealth Management UncoveredIndependent Investment Advisor Canada Can Be Fun For AnyoneThe 9-Minute Rule for Independent Financial Advisor Canada

Heath is an advice-only planner, therefore the guy does not handle his clients’ money immediately, nor does he sell them certain lending options. Heath says the benefit of this method to him would be that he doesn’t feel bound to provide some item to solve a client’s money issues. If an advisor is just equipped to market an insurance-based answer to a challenge, they might finish steering some one down an unproductive road during the name of hitting product sales quotas, according to him.“Most monetary solutions people in Canada, because they’re compensated on the basis of the products they offer market, they may be able have motivations to recommend one plan of action over another,” according to him.“I’ve picked this course of motion because I'm able to appear my personal consumers in their eyes and never feel like I’m benefiting from all of them by any means or attempting to make a sales pitch.” Tale continues below ad FCAC notes how you pay the advisor relies on this service membership they offer.

Private Wealth Management Canada Can Be Fun For Everyone

Heath and his ilk are compensated on a fee-only model, therefore they’re settled like a legal professional may be on a session-by-session basis or a hourly assessment rate (retirement planning canada). Depending on the range of solutions additionally the expertise or common customers of your own expert or planner, per hour costs vary inside the 100s or thousands, Heath claims

This can be up to $250,000 and above, according to him, which boxes away many Canadian families with this standard of service. Story continues below advertisement for many struggling to spend fees for advice-based techniques, and also for those not willing to quit some of their expense comes back or without sufficient money to get started with an advisor, there are several cheaper as well as no-cost options to take into account.

The smart Trick of Retirement Planning Canada That Nobody is Discussing

Tale goes on below advertisement discovering the right financial coordinator is a bit like internet dating, Heath says: You need to get a hold of someone who’s reliable, has an individuality match and it is best person the period of life you’re in (https://lwccareers.lindsey.edu/profiles/4232859-carlos-pryce). Some prefer their unique advisors to-be earlier with much more experience, he states, while others prefer some body more youthful who is going to ideally stick with all of them from early many years through retirement

The 15-Second Trick For Investment Consultant

One of the largest blunders somebody will make in choosing a consultant just isn't asking adequate concerns, Heath says. He’s amazed as he hears from clients that they’re stressed about asking concerns and possibly showing up dumb a trend the guy discovers is equally as normal with developed pros and older adults.“I’m amazed, because it’s their cash and they’re paying plenty of charges to those individuals,” according to him.“You deserve for the questions you have answered and also you are entitled to having an unbarred and honest relationship.” 6:11 Investment planning all Heath’s final advice can be applied whether you’re selecting outside economic support or you’re going it alone: become knowledgeable.

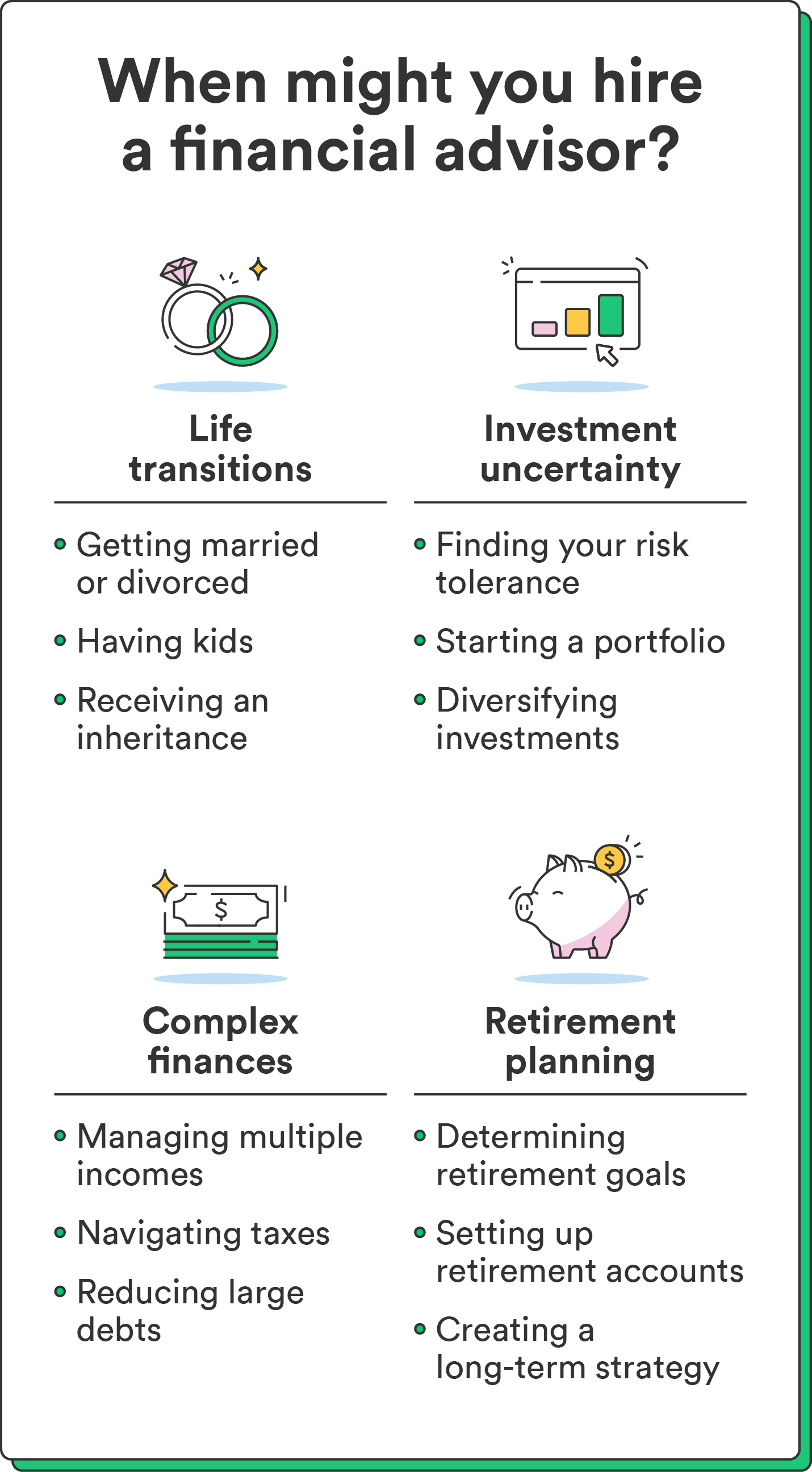

Here are four things to consider and have yourself whenever figuring out whether you need to engage the expertise of a financial advisor. Your web value is certainly not your income, but rather an amount which can help you recognize just what money you earn, how much it will save you, and for which you spend money, too.

Unknown Facts About Independent Financial Advisor Canada

Your infant is on just how. Your own divorce case is actually pending. You’re nearing your retirement. These as well as other significant existence occasions may remind the need to go to with a monetary specialist regarding the assets, your This Site financial targets, as well as other monetary things. Let’s state the mommy left you a tidy sum of cash inside her will.

You have sketched your very own economic strategy, but I have trouble sticking with it. An economic advisor may offer the liability you need to put your economic plan on track. They even may suggest ideas on how to modify your economic strategy - https://www.slideshare.net/carlosprycev8x5j2 to be able to optimize the possibility effects

Financial Advisor Victoria Bc Fundamentals Explained

Anybody can state they’re a monetary expert, but a consultant with professional designations is if at all possible the main one you should hire. In 2021, approximately 330,300 Us americans worked as private monetary analysts, in line with the U.S. Bureau of work studies (BLS). Most financial experts tend to be freelance, the agency claims - retirement planning canada. Generally, there are five kinds of economic analysts

Agents usually earn profits on deals they make. Brokers are controlled by U.S. Securities and Exchange Commission (SEC), the Investment field Regulatory Authority (FINRA) and condition securities regulators. A registered expense advisor, either a person or a company, is a lot like a registered agent. Both purchase and sell assets on the behalf of their clients.